How to receive money from Ecuador in the Philippines: Best and cheap ways in 2026

Waiting for an overseas payment? You might need to receive money from Ecuador in the Philippines from a friend or family member, or from a client or customer if you’re a freelancer or business owner, for example.

As the world is more and more connected across national borders, having smart ways to receive money from abroad is more important than ever. You could receive an international money transfer from Ecuador in the Philippines using a multi-currency account from Wise, your bank, in cash, or with a wallet provider like GCash. All these options have their own features and fees - this guide covers what you need to know.

Best ways to receive money from Ecuador to the Philippines- Fees overview

Method | Receiving fee | Exchange rate | Sending fee | Intermediary bank fees |

|---|---|---|---|---|

Wise multi-currency account | Low, transparent fees | Mid-market exchange rate | Low, transparent fees | Not usually applied |

Bank transfer | Fees may be 100 PHP - 150 PHP | Exchange rate may include a markup | Variable fee based on bank | Depend on SWIFT partners used |

Receive cash | No fee | Exchange rate may include a markup | Variable fee based on provider | Not usually applied |

Paypal | No fee | Exchange rate may include a markup | Fee depends on sender location | Not usually applied |

Gcash | Fees may apply depending on transfer details | Exchange rate may include a markup | Fee depends on transfer type | Not usually applied |

Maya | Fees may apply depending on transfer details | Exchange rate may include a markup | Fee depends on transfer type | Not usually applied |

Fees may apply depending on the way your payment is sent from Ecuador to the Philippines - which can be paid by either the sender or the recipient, or both. One of the largest costs tends to be included in the exchange rate. One way to avoid unexpected currency exchange fees is to use a Wise multi-currency account to receive money from Ecuador. Wise uses the mid-market exchange rate with low, transparent service fees - we’ll look at this, and other methods, next.

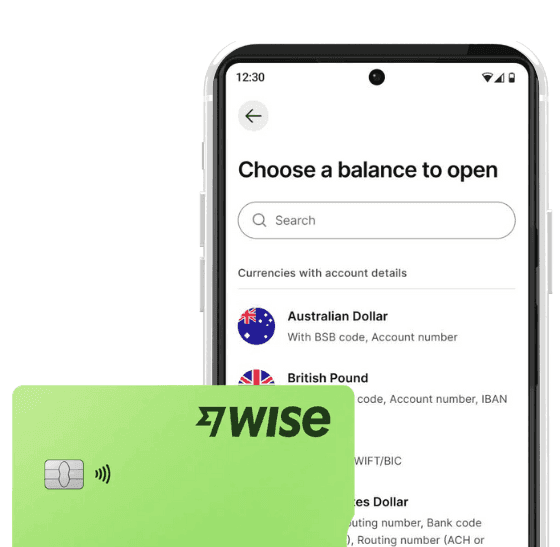

1. Wise multi-currency account

Open a Wise account online or with your phone, and get local account information to receive payments from US Dollar in the Philippines conveniently and for low costs. You can hold your balance in many different currencies, to spend later, or to send payments to others whenever you need to. This helps you avoid unnecessary currency conversion and keep down your costs.

Wise accounts can hold 40+ currencies, and offer account details for 20+ currencies so you can receive local and SWIFT payments conveniently. Hold your balance in the foreign currency, or convert back to PHP with fees from 0.57%. Or you can use your balance to send money overseas to 40+ countries, or to spend with a Wise card in 150+ countries.

40+ currencies supported for holding and exchange

Mid market rate currency conversion

Account information available for 20+ currencies

- Receive payments to Wise with account details in 23 currencies

- Hold and exchange 40+ currencies

- Send money quickly, online and in app, to bank accounts in 160+ countries

Wise account

The Wise multi currency account can be opened online or in the Wise app, with no monthly fee, and no minimum balance requirement. Use Wise to receive, send and convert 40+ currencies. Your Wise account comes with account details for 23 currencies, which can be used to receive international payments - including getting paid quickly and conveniently from US Dollar. Hold your balance in your account, send to others, withdraw to your bank, or get a Wise card to spend at home and abroad easily.

Go to WiseHow much does it cost to receive money with Wise from Ecuador?

With Wise you can get account details in AUD, CAD, USD, EUR, GBP, HUF, MYR, NZD, and SGD. Once you have a payment, you can convert to the currency you need to spend in, using the mid market rate, low and transparent fees

How much can I receive with Wise from US Dollar ?

The Wise limits for sending money from Ecuador to the Philippines are usually pretty high. You can receive up to 9 million PHP to a bank in the Philippines with Wise. While limits for other currencies can vary a bit depending on factors like how the sender chooses to pay for the transfer, they’re usually set around the equivalent of 1 million GBP.

Bear in mind that the sender needs to check if any other limits apply to the provider they send money with. They might apply a limit on their end which is lower than the Wise limit.

2. A bank-to-bank transfer from Ecuador

Another option when sending money from Ecuador to the Philippines is to use a bank to bank transfer. In this case, the sender will arrange a payment with their own bank, to be deposited to your bank account in the Philippines in PHP.

There are a few downsides here, including relatively high fees which can include a markup on the exchange rate. Bank to bank transfers can also take a few days when processed through the SWIFT network. While they may arrive quickly on some currency routes, they can take up to 5 days to be deposited in some cases. All that said, a bank to bank transfer is familiar and reliable and so still commonly used.

How can I receive money in my bank account

If you have a bank account in the Philippines, you can simply give your sender in Ecuador your account details, and have them send you money there. There are usually a few steps to open a bank account, which you may be able to complete online - or you may need to go to a branch to show your paperwork and get set up. You’ll always need to provide some ID for verification, and banks may also ask you to provide a minimum opening deposit.

Once you have an active bank account, you’ll be provided with account details, including an account number or IBAN, and any other information needed to receive a payment from abroad, such as the bank’s own SWIFT/BIC code. Give these to the sender and they can use them to bank a bank to bank transfer from Ecuador in the Philippines. Once your money is cleared in your account - in about 3 to 5 days - it will be available to spend.

How much does it cost to receive money with my bank

You might meet some fairly high fees and marked up exchange rates with banks when receiving money from abroad. The exact costs to you depend on who you bank with and the value of the payment. The exact account you hold may also make a difference.

You’ll usually find a couple of possible costs to you:

Receive money fee applied by your bank

A conversion fee which could be paid by either the sender or receiver

Here are the receiving fees for a couple of popular banks in the Philippines:

Bank | Receiving fee | Transfer time |

|---|---|---|

BPI | 150 PHP | Delivery time depends on sender’s bank - can be 3 - 5 days |

Metrobank | 100 PHP | Delivery time depends on sender’s bank - can be 3 - 5 days |

3. Receiving cash from Ecuador

If you’d prefer, you can also ask your sender to visit a provider which offers money transfers for cash collection, to get your payment in cash. In this case you’ll have to make sure your sender has your full name as shown on ID, and then visit a branch location in person with ID to get your money.

This can be a pretty pricey option as there’s a lot of labour involved - costs can include both a transfer fee and an exchange rate markup. However, if you don’t want to use your bank account or if you’re in a hurry to get your money, receiving your payment in cash can still be a solid choice.

How to receive cash from abroad

If your sender wants to make their payment in cash they will need to pick a payment provider with a physical branch network so they can visit an agent and hand over their payment in person. The sender will then be given a reference number, so you can take this reference, with some ID, to a local agent to get the payment in cash.

One of the most well known providers of cash payments is Western Union. Coverage varies depending on where in the world the sender is, but there are lots of options available for payments in cash. There are some disadvantages here though - not least the inconvenience of needing to go out to collect your money. Fees can also be high for the sender.

How much does it cost to receive money in cash

International transfer services which specialise in cash payments can have pretty high fees and high mark-ups added. Instead, online alternatives such as Wise can be cheaper. With Wise you can have your money deposited quickly to your Wise account, and then use your Wise debit card to simply withdraw the funds from a local ATM when you’re ready. This can be more convenient than finding a branch of the cash transfer provider to get your money that way.

Here’s a look at the costs of receiving cash payments versus Wise as an alternative:

Provider | Fees |

|---|---|

Western Union | Variable send fee based on payment type and value Currency exchange includes a markup |

MoneyGram | Variable send fee based on payment type and value Currency exchange includes a markup |

Wise | Low, transparent fees No extra cost included in currency exchange |

4. Receiving money with PayPal

Mobile wallets like PayPal offer another way to get paid from abroad in various different currencies. If your sender has a PayPal account they can make a transfer - often instantly - to your PayPal account. You can then withdraw to a bank or keep your PayPal balance for spending later.

PayPal international fees can be quite high. They do vary from country to country and can vary based on how the sender wants to pay. If currency conversion is needed, there’s often a fee here, as well as any upfront transfer fee that applies.

How to receive money with PayPal from Ecuador

If someone sends you money to PayPal it will be automatically credited to your PayPal account without you needing to take any action. All the sender should need is your name, and either your email address or phone number.

Once you have a PayPal balance you can use it to shop online or transfer to a bank. Bear in mind that fees may apply to withdraw your funds including currency conversion fees if your balance is in a different currency to the bank you withdraw to.

How much does it cost to receive money with PayPal

There’s usually no fee for the recipient to receive money from PayPal. The costs are covered by the sender. Somewhere along the line there may be a currency conversion fee which may be paid by the sender or by the recipient. This fee can vary but is often 3% to 4%.

What exchange rate does PayPal have?

If you use a PayPal Philippines account to convert a balance from one currency to another, the PayPal fee is 4%. This cost is added to the exchange rate used to manage the conversion of your balance.

5. Receiving money with Gcash

If you have a fully verified GCash account you can receive a remittance from abroad to your GCash account. You’ll need to upload a few documents and some additional information to upgrade your GCash account to fully verified before you can do this. Then once you have your GCash account ready, the person sending you money can usually arrange a transfer through a GCash partner using just your name and GCash phone number.

How to receive money with Gcash from Ecuador

When you’re sent a remittance payment to GCash you’ll usually have to claim it in the app. To do this you’ll need a reference code which the person sending you money will give you once they have arranged the payment. You can then select the remittance partner the sender used in the GCash app, enter the amount you’re getting, the reason for the payment, and the reference code the sender gave you, to receive your money.

How much does it cost to receive money with Gcash

There’s no GCash fee if the payment is sent to you as a remittance through a GCash remittance partner. There are some fees with a few different types of GCash cash ins, though - so do check based on the way the sender arranges the payment.

What exchange rate does Gcash have?

The exchange rate used to convert your payment to PHP for deposit to GCash may be set by the remittance partner selected by the sender. In this case, a fee might apply to the rate used, which isn’t always easy to see, and which may mean you receive less than you expected to.

6. Receiving money with Maya

You can receive a payment in PHP to Maya through Western Union, or the person sending you money could use MoneyGram to send a payment to your Maya Visa card. In order to receive a remittance with Maya you must have an upgraded account. Before the sender arranges the transfer to you, complete the upgrade process by uploading some additional documents for verification.

Best ways to receive money from Ecuador - pros and cons

Method | Pros | Cons |

|---|---|---|

Wise multi-currency account | ✅ Receive in select foreign currencies ✅ Mid market exchange rate ✅Low or no fees for many payments | ❌No cash payments ❌No branch network |

Bank transfer | ✅Familiar and reliable ✅Available from most banks globally | ❌High fees can apply on both the sender and the recipient ❌Exchange rates are likely to include a markup |

Receive cash | ✅Convenient for the recipient ✅Can be a very fast way to get your money | ❌Costs can be high due to the labour required ❌Exchange rates vary and can include fees |

Paypal | ✅Transfers may settle to PayPal instantly ✅Receive 25+ currencies | ❌Fees can be high for the sender ❌Exchange rates include a 4% fee |

GCash | ✅Receive through many different remittance partners ✅Easy to use for spending in the Philippines | ❌Fees apply for the sender ❌Exchange rates vary and can include fees |

Maya | ✅Get paid to your wallet or Visa card ✅Popular way to spend and pay bills | ❌Convenience fees may apply to recipient ❌Exchange rates are likely to include a markup |

How to receive money with Maya from Ecuador

If the person sending you money to Maya uses Western Union you’ll need to ask them for the 10 digit MTCN - a reference you’ll need to use to claim your payment. Then, once the payment is processed you can go to the Maya app, enter the sender name, the MTCN and the payment amount, to claim your remittance.

How much does it cost to receive money with Maya

Depending on the way the sender arranges the payment to Maya, you may pay a convenience fee for your remittance. If you receive under 8,000 PHP in a month as a remittance to Maya, these fees are refunded to you. Where fees apply they vary between partners, and can be around 2% of the payment amount.

What exchange rate does Maya have?

The payment sent to your Maya wallet from overseas will be converted to PHP by the remittance partner the sender selects. The exchange rate which applies depends on the partner used, and the currency they’re using. It’s likely that the rate will include a markup - a percentage fee added to the rate you’ll see on Google.

How to receive money from Ecuador

There are plenty of reasons why you might need to receive money from Ecuador. In all cases, you have different options for receiving money. The right one for you will depend on your personal preferences and the payment type.

Perhaps you’re receiving money from abroad as:

An inheritance - you may be receiving a large amount of money. Getting paid to your bank or to an account with high receive limits like Wise could make most sense.

A gift - the best method to receive a gift may depend on the value and urgency - for small payments a provider like Western Union allows instant cash collection - but has low limits. For higher values, stick with a bank or a provider like Wise

A transfer between accounts in your own name - perhaps you sold a property for example - repatriate your funds with a bank to bank transfer or with Wise

A payment from family or friends - if you need the money quickly, you could consider GCash, Maya, PayPal or a cash transfer with a provider like Western Union

A pension transfer - options like PayPal or Western Union are not likely to be economical. Manage a secure and fast international transfer with a bank to bank payment or with a specialist money transfer from a provider like Wise.

How much does it cost to receive money from Ecuador?

There are several different types of costs associated with receiving money from abroad, which can include:

Upfront transfer fees paid to your bank or international money transfer service

Currency conversion fees which may be split out or combined in the rate used for exchange

Recipient bank and intermediary bank charges when sending with SWIFT

The fees for different payment types can vary enormously. For example, if you’re receiving a payment to a wallet like GCash or Maya your sender may have to pay a fee to the wallet partner they select, and an exchange fee is likely to apply. For a provider like PayPal you may not need to pay anything to receive a foreign currency payment, but converting it to PHP comes with a 4% fee.

Compare the different payment methods based on costs - often using a multi-currency account like Wise which has low fees and uses the mid-market rate can be an economical and easy option.

How much money can you receive from Ecuador?

Different payment providers and banks have their own receiving limits. Usually banks have pretty high receiving limits. Wise also has a high receiving limit which can vary based on the currencies involved. Cash payments can have relatively low limits, and sending to PayPal can also have pretty low limits based on where the payment originates from. If you’re using an account from GCash or Maya, you may have varied limits depending on your account status and type.

Different factors might affect the amount you can receive, including regulatory limits imposed by the sending and receiving countries. The sender can see their own bank or provider’s limits when they set up your payment - at the same time, the provider will confirm if your payment may be rejected because of specific local laws.

How long does it take for a beneficiary to receive money from Ecuador?

Transfer times can vary - but you may be looking at something like this, depending on the transfer method selected:

Transfer to Wise - payments sent through Wise can arrive quickly or instantly

Bank to bank transfer - SWIFT payments may take 3 - 5 days

Cash collection - cash may be available in minutes when the sender pays by cash or card

PayPal - deposits to PayPal are usually pretty much instant, but withdrawing to your bank may take a few days

GCash - payment deposit time depends on the partner chosen and how the sender pays

Maya - payment deposit time depends on the partner chosen and how the sender pays

Ultimately the factors that influence the speed of your transfer include the provider used, the transfer amount, the currency conversion processes, and any holidays or weekends that might delay processing in both the Philippines and Ecuador.

How to send money to someone without a bank account

You can send money to someone without a bank account in a few different ways. For example, the recipient can open a Wise account, you could send to PayPal, or you might prefer cash pick up services.

Send to a Wise account - recipient will need to create and verify a Wise account online or in app, and can then receive payments for free with local account details

Send to a wallet like GCash, Maya or PayPal - payments may be instant if you have a provider account already - fees can be high to convert currencies

Send for cash pick up - relatively expensive option, but can be very quick if you’re close to an agent to get your money

What details are needed to receive money internationally?

If you’re receiving money from overseas for cash collection, the sender needs your full name as shown on your ID. For payments to PayPal, GCash or Maya, the sender usually only needs your email or phone number.

For payments made to banks, or to a Wise account you could need some or all of the following:

Recipient's full name

Recipient's bank or Wise account number

Recipient's bank SWIFT/BIC code

Recipient's bank's name and address

Other information might be needed depending on the details of the payment, such as an IBAN for European transfers, a routing number for US transfers, or your sort code for payments in the UK.

Providing incorrect information can mean your payment is delayed, rejected, or sent to the wrong place. Double check account numbers and names, and verify the information with the recipient's bank before you make your payment, to avoid delays or errors.

Conclusion - Best ways to send and receive money to Ecuador

There’s no single best way to send or receive money internationally. Instead, there are lots of different options which may suit different situations. If you’re looking for convenient ways to receive money in a selection of currencies, with low or no fees, Wise might be the best option. Or, if you’re in a hurry and need your money in cash, a cash collection service like Western Union might help. Really it all depends on what's important in your particular circumstances - but this guide should help you pick the right method for your needs.

FAQ - How to receive money from Ecuador

1. What is the first thing you do when you receive money?

What to do when you receive money depends on the payment method provided. If you’ve received money to a bank or Wise account there’s no need to take action - just check your mobile banking to see when the money arrives. If you’ve been sent a payment in cash you’ll need to take your ID to an agent location to get your money.

2. Best app to send and receive money

There’s no single best app to send or receive money internationally. For low cost international payments you can make and receive in the Philippines check out Wise. In our comparison and roundup, Wise could be the cheapest app to send money, with ways to receive payments with local details with low or no fees.

3. What is the cheapest way to receive international payments in the Philippines?

Compare a few options to receive international payments in the Philippines. While you could use a bank or cash services, the cheapest option may be to use a fully digital provider like Wise. Wise uses the mid-market exchange rate with low, transparent fees.

4. How much can I get paid from overseas in the Philippines?

Different banks and providers have their own payment limits. Check with your bank, or take a look at Wise which has very high limits for many incoming currency payments.